Click here to subscribe today or Login.

A story on page 1 of Sunday’s business section reported on how the Pennsylvania Budget and Policy Center believes we should reconsider levying a Severance Tax on natural gas extracted in Pennsylvania through “unconventional wells” (read: “fracking”).

This is a debate we had when the fracking boom took off in 2011, and again when then-Gov. Tom Wolf, a Democrat, proposed a severance tax in 2015. Obviously, severance tax proponents lost both times, with the state opting for — and sticking with — an “impact fee.”

As Budget and Policy Center Director Marc Stier pointed out during an online media event, the problem is that the impact fee does not increase when the price of natural gas goes up or the amount of gas produced rises (you can see the full slide-show presentation at krc-pbpc.org, use their search feature to look for “severance tax”)

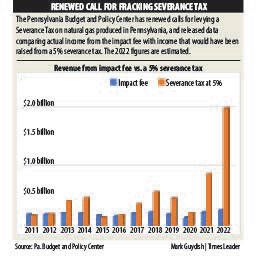

A chart the center presented showed that in some years this would not have made much of a difference. Comparing the actual revenue from the impact fee to the money that would have been raised by a 5% severance tax, the center showed a severance tax would have raised little more or even less than the impact fee in 2011, 2012, 2015 and 2016. Mind you it would still be more than the impact fee alone, because the center proposes keeping the impact fee intact.

There were a few years where the severance tax would have substantially boosted state revenue, but it wasn’t until 2021, and especially 2022 that the difference between the two became truly glaring. The center notes production has increased steadily even as the price of gas fluctuated. To quote from the center’s presentation slide: “… in 2021 and 2022, production was at an all-time high while the price of gas increased from 63-cents in 2020 to an estimated $5.27 in 2022.

“When production is high and gas prices are high, a severance tax will bring in significantly more money than the impact fee will.”

The center estimates that a 5% severance tax would have raised about $1.7 billion in 2022, thanks to the big bump in the price of gas.

Stier dismissed two old arguments against a severance tax.

First: Fear that companies would simply stop drilling in Pennsylvania are unwarranted because we remain the only state without as severance tax, and companies are still drilling and extracting in states with such a levy, even in states where the tax is higher than the 5% the center is recommending. Moreover, demand is expected to keep growing as Europe weens itself off gas from Russia and turns to the U.S. to help make up the difference.

Second: Claims that a severance tax would get passed on to Pennsylvania residents are unwarranted simply because — thanks to pipelines and compressed gas transportation technologies — natural gas is a fungible (our word, not his) commodity. More bluntly: Nothing requires companies to sell gas drilled in Pennsylvania to Pennsylvanians.

Stier said most of the gas extracted here is sold elsewhere. By extension, that would mean we are buying natural gas from out of state. And since we are the only state without a severance tax, that in turn means we are likely paying for a severance tax levied elsewhere.

We’re not advocating the center’s proposal of a severance tax. But the arguments seem strong, particularly with the newest data on production and price, and the growing demand for natural gas. At the very least, the state legislature should revisit a severance tax option, keeping open minds and an unvarnished view of future state needs.

– Times Leader